We finally did it lads, at last, we’re all millionaires in Venezuela!

We got so much money that we deal and trade in millions like its pocket change; one slide of your debit card into that point of sale machine and poof, millions dilute from your account like salt on water, a few clicks here and there and bam! You just wired thirty million to another account—assuming, of course, that your bank’s website actually managed to load and that our precarious internet is cooperating.

Two million for 15 eggs? Pfft that’s nothing.

Five million for a tray of ground beef? Cha-ching!

Seventeen million blown in a bag detergent? No problemo! We’re mil-lion-aires after all.

Yeah boy, better crack open that ice cold Mike’s Hard lemonade, crank up that Imagine Dragons, and take your shirt off because baby, we’re living #TheGoodLife.

Except not, we’re not really rich, far from it rather.

We’re the country with the world’s most proven oil reserves, we possess numerous other natural resources, and yet our currency is now so worthless that a blank sheet of paper is worth more, and I’m not even kidding.

And there’s no signs of this improving in the slightless, not with our current status quo in place.

En Venezuela: una mujer paga un kilo de mortadela de 1 millón de bolívares con billetes de Bs. 100. Es decir; 10 mil billetes. pic.twitter.com/8WnnSkgr2x

— Maryorin (@maryorinmendez) June 4, 2018

To hyperinflate even further beyond

Now that our annual inflation rate has breached the 35,000% threshold we’ve entered a whole new level of absurdity, just in this past month alone certain items have doubled—even tripled in price, some of them have raised in price between the time I began to take notes for this article and the time I post it.

Our Central Bank stopped releasing most official statistics (including inflation) in 2014, which complicates everything when it comes to obtaining official data about our country’s dire state—gee I wonder why would they do such a thing…

Venezuela's annual inflation rate measured for today, 6/25/18, is 36,569% pic.twitter.com/S9Dar31H5y

— Prof. Steve Hanke (@steve_hanke) June 25, 2018

If you’re living here you should no longer be amazed if something that costed you 800,000 Bolivares a couple days ago is now over two, even three million—you expect it to be so nowadays; to brace oneself for the massive weekly raise in prices is part of our new normal.

I paid 450,000 Bolivares for milk at the end of May, by June 01 that same milk was 590,000, today it’s going for 950,000; by the time you read this chances are that its price has either doubled or worse.

I took a look at the article about wages and salaries that I posted back in September 2017 and checked the price tags that I posted back then, I gotta say that it feels quite surreal for me to see a kilogram of detergent for 12,950 Bolivares when right now that same bag will cost you over three million Bolivares; mind you, the prices shown in that old article were quite outrageous back then.

With prices jumping up exponentially in price so fast you tend to forget what they used to be at two or three months ago. If you go to any supermarket, hold any random item in your hands, and then compare its current price with what it used to be a year ago then you can be one hundred percent sure that its price in 2017 was but a mere fraction of what it is today.

Hyperinflation poses a dilemma on us all, either you suck it up, make the sacrifice, and pay for it today or risk not being able to afford it tomorrow—or ever again.

Let’s do a little imagination exercise here:

Let’s say you live in a country with a stable currency and a functional economy, let’s say that you’ve decided to treat yourself to a nice ice cream, buy a new pair of shoes, perhaps go on a date with your significant other, or even delight your palate with a fat juicy burger, but unfortunately you’re a little short on cash right now so you can’t spare any superfluous expenses.

It happens, but its ok because once you’re caught up with your obligations and your budget goes from red to black then you’ll be able to cover the costs of that which you wanted to do a few days ago.

That is something that the large majority of Venezuelans no longer can do.

For the majority of the country right now goes like this: If you see a particular item in a store, let’s say toilet paper for example, you have to somehow stretch your already limited budget and try and buy two, four, or even more of them if you can—because first, you have no idea when it’ll be the next time you see it and second, you don’t know how much more expensive it’ll be when you do see it again.

Hell, you can even flip it later down the line, or trade it for something else that you happen to need.

It is not uncommon to see many items without price tags on store shelves these days, prices are changing so rapidly that it’s just not worth the effort to constantly print new labels every couple days, instead relying on price checker scanners and whatnot.

Throwing gasoline on the flames

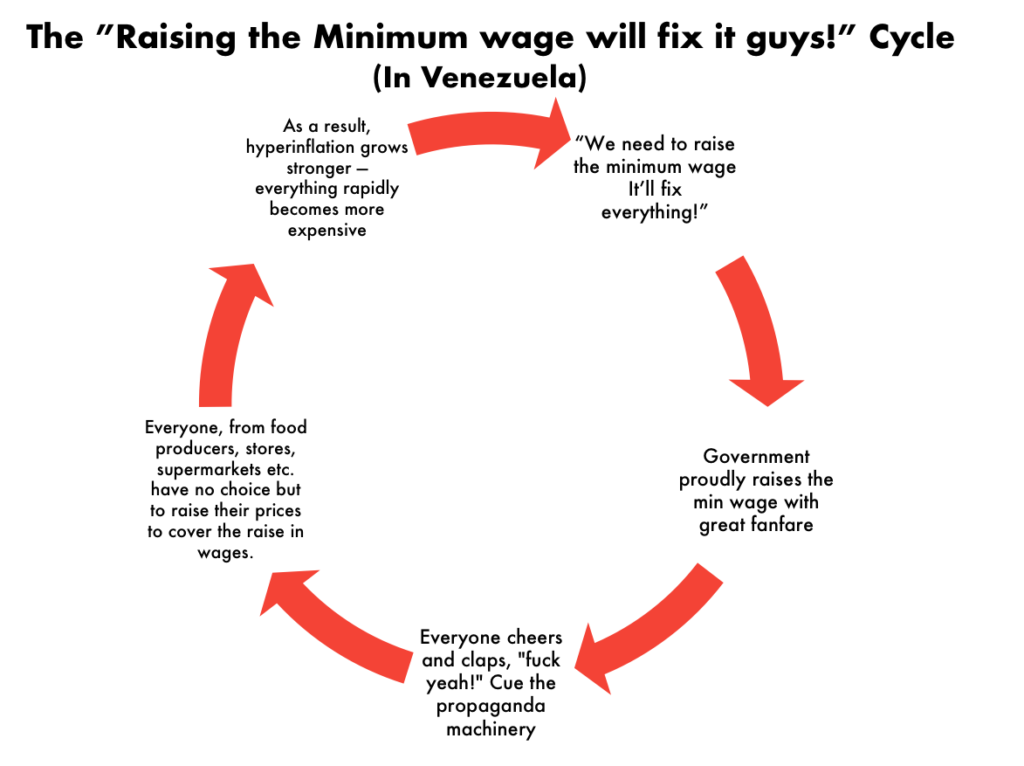

Last week, our monthly minimum wage (plus bonuses and all) was 2,550,000.00 Bolivares per month; on June 20 it was raised yet again to 5,196,000.00 per month; unless I counted wrong, this is the 45th time they’ve raised it ever since the “Bolivarian Revolution” began nearly two decades ago.

For comparison, on July 01, 2017, the min wage (plus bonuses) was raised to 250,531.00 per month.

Someone not familiar with the Venezuelan disaster might think that this is a lot—and the regime will claim so too, both nationally and internationally, that’s a task of their massive media apparatus, but let’s convert these amounts to US Dollars using the “illegal” black market rates—which the government has pretty much legalized recently despite heavily penalizing the free use and trade of foreign currencies.

In July 03, 2017, those 250,531.00 Bolivares were roughly $32.19 when converted using the black market rates of that time.

The Monthly minimum wage today, Bs.5,196,000.00 is only $1.73 at today’s average black market rates (there’s more than one now)

I’m most confident that by the time I hit the publish button on this post and you read these words it’ll be less than that.

We’ve reached a point where we no longer celebrate minimum wage raises—we abhor and dread them because of all that it implies, it just makes everything more expensive, as raising the minimum wage so often and continuously printing more inorganic money at such at rapid pace just makes everything worse.

This is all akin to throwing a bucket of gasoline to the raging flames of hyperinflation and expecting to quell the flames with it, simply printing more money alone doesn’t and won’t fix this mess—it does quite the opposite, it exacerbates it, but that is exactly what the government is doing, everything other action and measure they so brazenly announce in order to fight the “Economic War™” that they themselves invented is just charades and pantomimes.

Worst of all, the government announces these minimum wage raises like it’s some sort of grandiose accomplishment, and their ever expanding propaganda machine is once again making sure of that.

Allow me to use a personal example just to show how out of control hyperinflation has become, back in 2016 one of my mother’s chemo bills amounted to 597,000 Bolivares, this was just for the operational costs of six rounds of chemotherapy, excluding the chemo meds themselves, tests, CT scans, etc. Costly at the time? Yes, but manageable.

By circa November 2017, you’d spend that same amount of Bolivares filling a supermarket cart with chicken, beef, pork, ham, cheese, eggs, fruits, vegetables, beans, bread, crackers, some sweets, ketchup, mayo, other types of sauces, and a few treats even.

Right now? That same amount barely gets you three onions.

A million Bolívares right here: pic.twitter.com/zUiSQ7HYbt

— Kaleb (@KalebPrime) June 22, 2018

Credit Cards to the rescue

Credit Cards continue to be the best way to pay for goods and services in Venezuela, more so than ever before, much to the issuing banks’ dismay.

In the right hands they have become a flimsy yet useful shield against hyperinflation, specially with the low interest rates that are nowhere near the price jumps caused by the hyperinflation spiral we’re going through; unfortunately, it is an instrument that not everyone has access to, and it can only go so far.

All of these constant raises in the minimum wage have often been accompanied with raises in our Tax unit, the Tax Unit was raised from 850 Bolivares to 1,200 per unit alongside the most recent minimum wage raise on June 20, despite the fact that our laws say that it can only be raised once per year and only within the first fifteen days of every February, but we all know that the government doesn’t care about their own laws, so yeah….

This Tax Unit its employed to calculate the costs of certain services such as Passport related services, revenue stamps, food bonus amounts, fines, credit card limits, etc.

Earlier this year, the Superintendence of Banking Institutions in Venezuela decreed that the maximum limit for credit cards was equivalent to 120,000 Tax Units, thus the maximum amount for credit cards right now is 144,000,000.00 Bolivares, a limit that not every cardholder enjoys.

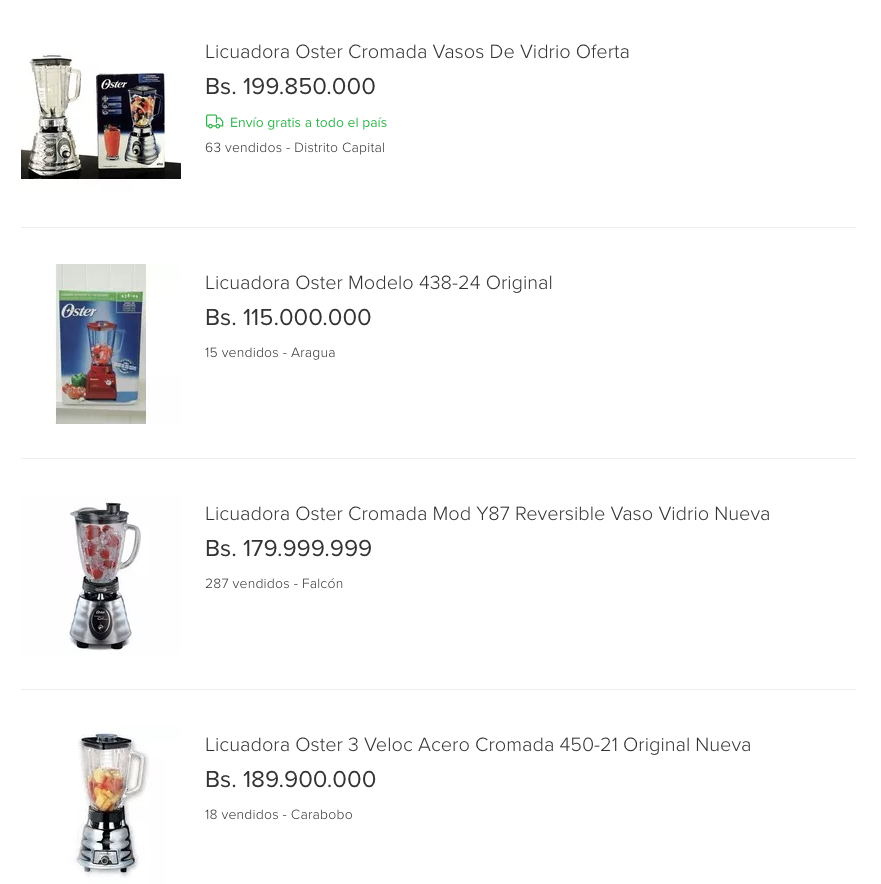

Again, this might seem like a lot, it is a big number (for you), but 144 million Bolivares is not even $50 anymore; let’s take those 144 million and weight them against the price of say, a blender:

Still, those that possess one or more credit cards have a small buckler to fight against the constant price increases; they can go to a supermarket at the start of the month and buy a few items, and by the time they pay their debt to the bank those items are already twice as expensive.

A large majority of cardholders have long since maxed their credit cards at the lack of a better alternative when it comes to feeding their families, and I’m aware that this is not an isolated problem to Venezuela, but it’s gotten so bad that banks are now reducing the credit limit on some cardholders.

Worthless Milllions

Paradoxically we now have way more money in our hands than ever before, but all of it is utterly worthless; by the time the newly announced Sovereign Bolivar banknotes (same thing but with three less zeroes) enter circulation they’ll have already lost a significant portion of its value.

The entire 2007-2015 series of Bolivar banknotes that are still circulating, which range from 2 to 100 Bolivares, have absolutely no real value left whatsoever; you might as well use them as napkins, post-it notes, or in my case, as a makeshift wedge to keep your ADSL connection stable long enough until I finally replaced that accursed faulty wall outlet. Coins have more value if you melt them and repurpose its materials somehow.

Whatever value they might have purely stems from a collectible perspective, enthusiast numismatists have been collecting them for a while, and I’ve often been asked for a few banknotes by several people but I’m afraid that the government made it illegal for us to send out cash outside these borders (not like it stops the national guard and those with the right contacts and resources from doing it but still).

Souvenirs of the Venezuelan tragedy, if you will.

Personally, I’ve considered learning a bit of origami with whatever banknotes I have left (except the ones that still have some use of course) until I leave this country, I mean, its certainly cheaper than buying paper, which even banks are in short supply of nowadays.

There are cases of people utilizing these near worthless banknotes to create something new, beautiful, and unique.

Such is the case of Wilmer Rojas, a young man that began collecting worthless Bolivares and uses them to craft items, from crowns to purses; the amount of cash he uses to craft one of those purses is nowhere close to what a regular one costs in the market, let alone enough to buy a bag of rice even.

Another example is Jose Leon, a graphic designer that started to draw on Bs.2 Banknotes once people stopped accepting them, turning what had become an inconvenience into pieces of art that have actual value that far surpasses the banknote itself.

The persistence of the Venezuelan regime in maintaining the same failed economic practices, repeating the same failed precepts, putting their Marxist doctrines on top of everything whilst blaming others for their mismanagement over and over is what has, is, and continues to be the main cause of the death of our currency.

Our banknotes are worth less than Monopoly money, I honestly wish I was joking.

My beloved Venezuela, where everyone is a millionaire except no one actually is.

But hey, just gotta print more money to fix this mess, am I right?

¯\_(ツ)_/¯

-Kal

1 Comment

Dude, just axe more zeroes lmao | ckaleb[dot]com · June 1, 2020 at 12:22 pm

[…] will soon have had eight zeroes axed over the past ten years. I suppose that we’ll stop being millionaires in a couple weeks (not like we were really millionaires to begin with) but even if this goes […]

Comments are closed.