The Bolivar is dead, and everyone knows it

What little value it still retained evaporated throughout 2017, a currency that once was worth more than the United States Dollar is now not even worth printing on paper.

Ever since the current currency exchange control system was stablished in early 2003, access to any form of foreign currency has been troublesome, controlled, and outright convoluted—nowadays impossible, as evidenced by the current black market exchange rates.

An ever growing amount of people are availing themselves of any method or mechanism that allows access to the mighty US dollar as a means to survive—even farming video game currencies which are now worth more than the Bolivar itself are a far better or endeavor than working for a bolivar-based salary.

With the advent of cryptocurrencies, Venezuelans found in them a way to escape the rigorous currency exchange limitations and as a viable pathway that provides access to money and financial stability, something our currency no longer provides; in addition to being able to use them to purchase goods and services online, something that you may take for granted but it is quite difficult for us to do when the government has disconnected us economically from the rest of the world.

Mining in Venezuela had a shy start in 2012 but it rapidly flourished in the following years, by 2014 it started to become a viable way to escape inflation.

But as with everything else in this country, nothing is ever that simple and straightforward, mining any form of cryptocurrency in Venezuela is easier said than done; while yes, we have it easy in some aspects, we also have it harder in others, the risks often involve getting jailed even.

Is mining profitable in Venezuela?

tl;dr: Yes.

I won’t claim that I am expert in cryptocurrencies because I am certainly not—far from it actually, but I know one thing for sure: The government’s subsidies on utilities coupled with the obliteration of the Venezuelan Bolivar have inadvertently turned the country into one of the most profitable locations to mine crypto in the world—if you’re willing to take the risks that is.

If a Venezuelan or somebody else were to start mining crypto here, there’s a few things they’d have to keep in mind:

Getting the hardware:

Let’s start with the most important—and the hardest obstacle of them all from a Venezuelan standpoint, the one that not everyone can easily overcome: affording, importing, and obtaining proper mining equipment.

The main problem arises when you try to purchase even the simplest pieces of hardware, as you will have to wrestle though a hyperinflation that devours whatever acquisitive power you have left and a draconian foreign currency control that hinder your ability to gather the funds and means to purchase and import your gear with relative ease.

As with the majority of the countries in the world, we’ve always had to import every piece of computer hardware and suck up the high shipping costs and the ever increasing import taxes and fees (and the bribery if you want to get your stuff through customs without problems, never forget the bribery)

If for some reason you have to RMA one piece then get ready for a headache, it’s doable, but it’s a complete and utter nightmare, especially without a buddy outside that can help you out. Which is why you better be good at praying to the God(s) of your fathers, so your equipment gets divine protection from any potential malfunction—you’re gonna need it.

Of course, if you’re a foreigner and can easily get access to hardware, or have bank accounts outside of Venezuela then this is less of a problem, but you’d still have to defeat the Customs import boss stage.

If you simply don’t have the means and funds to get adequate mining hardware (basically, most of Venezuela), then your solution is to simply use whatever you have at your disposal, no matter how inefficient it is at mining—it’s better than nothing; hopefully that banged up old computer collecting dust in your closet will serve you well and can get you a small profit.

When you consider the fact that our minimum wage is less than $10 a month then yeah, any yield, no matter how insignificant, adds up in the end.

Who knows, it might even get you enough dosh to get stuff that’ll eventually help you scale up your mining.

Internet and Electricity costs

ggwp ez

The costs of utilities were frozen for such a long time and have severely staggered behind the hyper-inflationary curve; while there were some modest increases in rates during 2017 there is still an absurd and massive discrepancy in costs when you weight your utility bills against the costs of food or even water.

For reference, I will use the amount I had to pay for Internet (4MB ADSL line) and Electricity for December 2017.

Internet: Our internet might suck and be ranked among one of the slowest ones in the world, but it is virtually free at this point.

My Phone + Internet bill for December 2017 was Bs. 1,062.89 — $0.0050 at the current black market rates.

For comparison: A five gallon bottle of water is going for Bs.20,000.00 as of the time of this post, a Kilogram of cheese is well over 700,000.00 Bolivares.

You will pay more for water in a week than you will pay for internet here in a year, even if you’re under a more expensive plan.

Mining isn’t that bandwidth intensive, so you can make do with even the slowest speeds at our disposal (plans that are around 1mbps), if you already have your internet installed then you’re good to go.

Getting a new internet installation can be tricky due to the lack of materials as of late, of course, as with everything in this part of the world, bribing the right people can expedite things.

Electricity: The most important metric for miners in other countries is a non-issue in Venezuela, the one defining factor in profits is irrelevant to us.

Whereas people in other countries have to balance the power costs against their monthly yield to see if mining a determined currency is viable or not, we don’t even need to bother with that. Same with gasoline, our electricity costs are so dirt cheap they might as well be free.

Electricity is heavily subsidized, I am not mining anything in my house, just your average apartment with three people; we paid Bs. 2,692.86 for electricity in December 2017 (at least half of this amount is attributed to the garbage disposal fees in Caracas, which are paid alongside power)

That equals to $0.012 at current black market rates.

Let’s assume you have an array of computers mining 24/7, even if the power bill comes up to be 15,000-25,000 per month, or hell even if its spikes to 100,000 per month, it’s still next to nothing.

Is it risky though?

Now that you got your equipment in order and all setup, and now that you’ve laughed at the absurdly cheap internet/electricity costs here you think you’re on the easy path to that juicy crypto bux? Think again.

The authorities are aware of the prospective profits of cryptocurrencies, as with everything else, are actively desiring to regulate and control it, because trying to survive and get a profit is a crime in this country apparently.

It started as nothing more but rumor and hearsay over the years, that “the police was arresting people for mining crypto”, even I believed this to be just a rumor, and then the rumors were confirmed.

One of the first known case occurred in 2015, when Jose Padron, a Venezuelan Citizen, was arrested for three and a half months for the sole crime of mining bitcoins.

Since there is no legal framework in this country that says mining bitcoins is illegal, they’re taking a tangential excuse: energy theft, in his case, the authorities also claimed that he did not had all of his import paperwork in order.

For a bit of context, our country suffered through a severe energy shortage in recent years, power was rationed for hours in many states, while the situation has somewhat improved, blackouts still happen frequently, the government rewarded people that took efforts to reduce their power consumption with even more subsidies on their bills.

Even public offices operated at limited hours and days to reduce their load on the electric grid.

Those that were caught “stealing” energy were severely penalized, this is the excuse used by the authorities to harass, extort, and even jail civilians. Since mining is a power intensive task and the power consumption is heavily monitored, they can easily detect sudden surges and locate miners.

A more recent example took place on December 13, 2017, when the police seized a cluster of machines used to mine bitcoins.

There’s way more cases where the police authorities have arrested individuals and seized equipment, and many more cases of extortion, where they demand a slice of the cake lest you face the consequences.

Who knows how many times has it occurred beyond the publicly known cases.

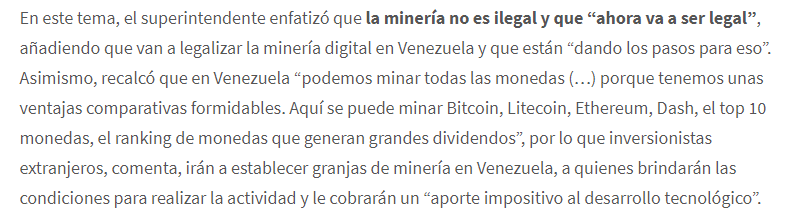

“Mining isn’t illegal, but it will now be legal”

– The Venezuelan Government

The government, aware that people have been harassed and extorted for mining cryptocurrencies in recent years, is now washing their hands off the whole mess.

Carlos Vargas, the new cryptocurrency superintendent in Venezuela, stated that they’re aware that authorities have overstepped and illegally seized equipment, as well as the permanent state of extortion that some individuals have endured.

Because of course, the government needs to control and regulate everything (even the hours where you can poop thanks to the rationing of water), they’re demanding those that wish to mine cryptocurrencies to register with the government to obtain a mining license, stating that “mining is not illegal—but it will now be legal”.

He also warned that “those that remain in anonymity will face the consequences of it”

Government meddling aside, can you buy stuff or pay for everyday services using crypto right now in Venezuela?

I’ve been often asked this, and the answer is “not directly” of course.

A considerable percentage of Venezuelans still do not have a bank account, let alone a debit card (the new de-facto form of payment given the paper cash shortage we’re going through), thus the idea of them paying using cryptocurrencies is still a bit far from becoming a reality; notwithstanding is also the fact that the concept of cryptocurrencies is still met with a lack of proper knowledge by many of our citizens.

In addition to that, there’s always been an intrinsic cultural preference for tangible forms of foreign currencies (cash). If you were to ask random Venezuelans on the street the majority will certainly tell you that they prefer to have physical Dollars or Euros that they can touch with their hands instead of say, Bitcoins or PayPal balance.

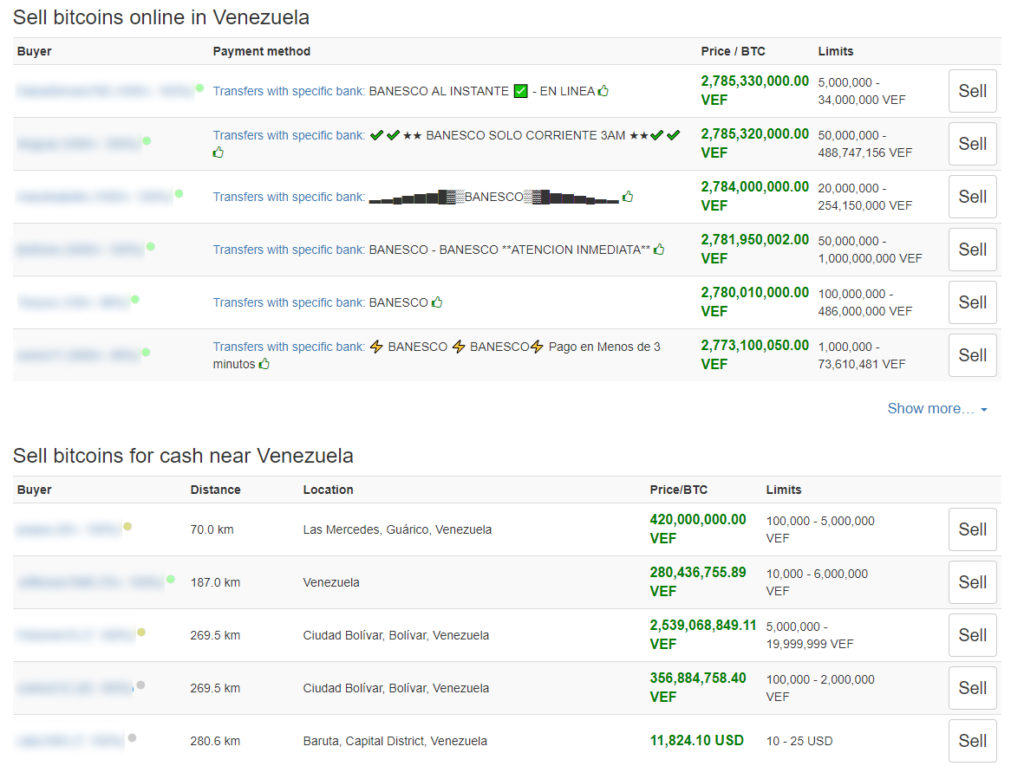

If you do have Bitcoins, Litecoins, Etherum, et al. and want to use them to buy food, pay for services, or even medicine (assuming you can find them here), your best bet is to trade these for local currency (or dollars if possible).

Localbitcoins is the most used website for trading BTC into VEF; unfortunately, most of them only trade in high amounts, leaving those that have tiny amounts out of luck; but if you have enough patience you will certainly be able to find a trustworthy trader that will accept yours.

Of course, this doesn’t apply to private trades between individuals.

Given the rapid plummet of the Bolivar, I wouldn’t certainly not advice to trade all of it at once, just cash out the bare minimum that you need at a time, more bang for your buck and all that.

The Petro

Last month, President Nicolas Maduro announced that Venezuela would soon have its first cryptocurrency, dubbed the “Petro”.

Of course, because the narrative now suits them, the government is now the premier expert in cryptocurrencies, second to none.

A staple of the government’s media machine is to undermine and shit talk everything that isn’t theirs, and boy, this case is no exception.

They are now praising the wonders of the blockchain technology, going so far as to assemble a “blockchain observatory” and assigning a crypto superintendent, praising the blockchain as yet another tool to fight “the evil US imperialism™”

At the same time, the government’s media machine is now openly criticizing bitcoin and other currencies of its nature, claiming that unlike the “Petro” they’re “not real currency.”

Unfortunately, not much has been informed to the public about it other than:

- It will be backed by our natural resources: oil, diamonds, gas, et al.

- Its value will be tied to that of our oil barrel.

- You cannot freely mine it.

- It will only be mined by the Venezuelan Government.

- The “white book” of the Petro was going to be released on January 14, it is now January 20 and it hasn’t been released yet.

- Its first offering will be of 100 million Petros (or 100 million oil barrels as they’re reffering to it)

- Registering on their website is a requirement if you want to participate in Petro shenanigans.

A few days ago, a Reddit post claimed that the Petro would likely be an ERC-20 token, using files that were hosted on the Venezuelan People’s Ministry for Communications and Information website as evidence. This was widely rejected by the government.

The US treasury department recently warned that those who invest in Petro could be in violation of the financial sanctions that the US government has imposed to Venezuela.

Will this wild endeavor yield real benefits for the country and its citizens? Or will it be yet another flop that only benefits the politburo elite like many other controlled systems that they’ve done in lieu of a free currency exchange?

I guess we will find out in the coming weeks…